3 min read

Christmas in July

The summer is in full swing and the holidays are probably the last thing on your mind. As much as we don’t want to think about snowflakes and holly...

Platform

What is Paytronix Guest Engagement Suite?

Combining online ordering, loyalty, omnichannel messaging, AI insights, and payments in one suite. Paytronix delivers relevant, personal experiences, at scale, that help improve your entire digital marketing funnel by creating amazing frictionless experiences.

A Complete Guest Engagement Suite

Online Ordering

Acquire new customers and capture valuable data with industry leading customization features.

Loyalty

Encourage more visits and higher spend with personalized promotions based on individual activity and preferences.

Catering

Grow your revenue, streamline operations, and expand your audience with a suite of catering tools.

CRM

Build great customer relationships with relevant personal omnichannel campaigns delivered at scale.

Artificial Intelligence

Leverage the most data from the most customer transactions to power 1:1 marketing campaigns and drive revenue.

Payments

Drive brand engagement by providing fast, frictionless guest payments.

Solutions

Paytronix Guest Engagement Solutions

We use data, customer experience expertise, and technology to solve everyday restaurant and convenience store challenges.

FlightPaths are structured Paytronix software onboarding journeys designed to simplify implementation and deliver maximum ROI.

Customer Success Plans (CSPs) are tiered service offerings designed to help you get the most from your Paytronix software, whether you prefer self-guided support or hands-on partnership.

Contactless Experiences

Accommodate your guests' changing preferences by providing safe, efficient service whether dining-in or taking out.

Customer Insights

Collect guest data and analyze behaviors to develop powerful targeted campaigns that produce amazing results.

Marketing Automation

Create and test campaigns across channels and segments to drive loyalty, incremental visits, and additional revenue.

Mobile Experiences

Provide convenient access to your brand, menus and loyalty program to drive retention with a branded or custom app.

Subscriptions

Create a frictionless, fun way to reward your most loyal customers for frequent visits and purchases while normalizing revenues.

Employee Dining

Attract and retain your employees with dollar value or percentage-based incentives and tiered benefits.

Order Experience Builder

Create powerful interactive, and appealing online menus that attract and acquire new customers simply and easily.

Loyalty Programs

High-impact customizable programs that increase spend, visit, and engagement with your brand.

Online Ordering

Maximize first-party digital sales with an exceptional guest experience.

Integrations

Launch your programs with more than 450 existing integrations.

Loyalty Programs

Deliver the same care you do in person with all your digital engagements.

Online Ordering

Drive more first-party orders and make it easy for your crew.

Loyalty Programs

Digital transformations start here - get to know your guests.

Online Ordering

Add a whole new sales channel to grow your business - digital ordering is in your future.

Integrations

We work with your environment - check it out

Tobacco Reporting

Comply with AGDC 2026 DTP Requirements

Company

We are here to help clients build their businesses by delivering amazing experiences for their guests.

Meet The Team

Our exceptional customer engagement innovations are delivered by a team of extraordinary people.

News/Press

A collection of press and media about our innovations, customers, and people.

Events

A schedule of upcoming tradeshows, conferences, and events that we will participate in.

Careers

Support

Paytronix Login

Order & Delivery Login

Resources

Paytronix Resources

Learn how to create great customer experiences with our free eBooks, webinars, articles, case studies, and customer interviews.

FlexPoint Service Catalog

Access FlexPoints are a cost-effective, flexible way to access our value-added services, to ensure you get greater impact from your Access software solution.

See Our Product In Action

E-Books

Learn more about topics important to the restaurant and c-store customer experience.

Reports

See how your brand stacks up against industry benchmarks, analysis, and research.

Blog

Catch up with our team of in-house experts for quick articles to help your business.

Case Studies

Learn how brands have used the Paytronix platform to increase revenue and engage with guests.

The brands winning now aren't competing on price. They're turning every transaction into a relationship. Discover how in the 2026 Trends Predictions Report.

2 min read

Mar 10, 2022

As gift card sales come roaring back and diners return with gusto, it’s worth taking a hard look at a common but costly practice that ends up taking a toll on restaurants: using gift cards as comp cards.

Complimentary (comp) programs entitle guests to receive products or special discounts at your restaurants. Whether used as a goodwill gesture for guests or to extend a privilege to employees, providing comps is a part of doing business.

Restaurants use gift cards as a means to comp guests. Like paper certificates, guests readily recognize gift cards, which are convenient to issue, and easy to redeem. Unfortunately, comp programs follow distinct financial accounting procedures. Failure to isolate comp transactions from standard gift card transactions creates a “double taxation” penalty that can overstate your sales tax and income tax burden by as much as 12%!

Common Pains of Comp Programs

Comps typically represent 3-5% of total sales — a meaningful slice of your business — and are often not well controlled or properly processed. The main risks of poorly administered comp programs include fraud and abuse, as well as improper financial accounting.

Fraud and Abuse – No One Wants to Lose Money

Inadequate measurement and control of comp programs can result in fraudulent behavior. Paytronix customers report that restaurants lose one in 10 controllable comp dollars to fraud. Paper certificates lack inherent controls and are particularly susceptible. Fraud is not limited to paper-based systems, though. A discount button on your POS system without appropriate controls also invites overuse and abuse.

Improper Financial Accounting = Increased Tax Burden

Improper processing of comp transactions also causes needless financial losses. Recording the value of comp transactions requires specific accounting treatment. You fall victim to the “double taxation” penalty when that treatment is applied incorrectly.

Fundamentally, this taxation penalty occurs because the comp value is a restaurant expense, not revenue. When you fail to appropriately recognize this expense, you artificially inflate your revenues, overstate your net income, and thereby overstate your income and sales tax liability. This overstating is a costly and unnecessary expense.

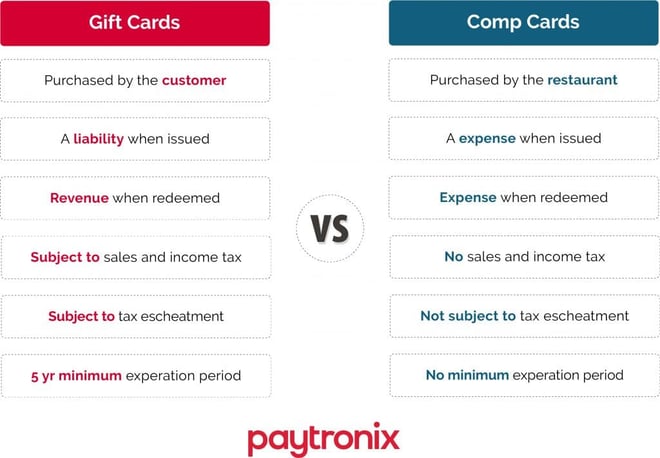

Gift Cards, the Common Offender

This taxation penalty often arises when comp situations are handled by issuing a gift card. A gift card is the wrong device for comp transactions. Comp cards and gift cards are both valuable elements in retaining and attracting guests. But, they are distinctly different instruments.

A gift card is sold to guests, represents taxable revenue, and appears on the balance sheet as an accounting liability until redemption.

The value on a comp card is recognized as an accounting expense. A comp should appear as a discount that lowers the subtotal of a guest’s check and reduces the amount of tax associated with the transaction. The comp is given to a guest – not sold – and therefore should be reflected as a business expense, not as revenue.

Consequences of Mixing Gift and Comp Cards

Companies have sometimes had to restate earnings to correct for improper comp treatment. This is because they could not differentiate their comp and gift card balances and were forced by auditors to expense 25% of the combined outstanding balance.

Many chains try to backout the comp transactions in their general ledger, but it is difficult to differentiate these transactions and to accurately account for the amount of comps extended. For example, some companies require that receipts be mailed to corporate for processing. This is a labor-intensive process where lost and unidentified receipts understate the true comp amounts.

Plus, you cannot back out the sales tax. States generally conduct audits based on POS reports, not general ledger data. Assigning proper tax rates gets very complex when a check has different items with different tax rates and is paid with comp and other tenders.

In short, fraud and mishandled comp programs cost you money, so our comp cards provide you with a safe, practical way to offer complimentary value to guests while halting fraud and assuring proper accounting for every comp transaction.

3 min read

The summer is in full swing and the holidays are probably the last thing on your mind. As much as we don’t want to think about snowflakes and holly...

3 min read

It’s no secret that restaurants nationwide are hurting as we combat the spread of COVID-19. Some have closed completely for the time being, while...

3 min read

Gift cards outperform other marketing tools for most businesses. Unlike coupons or discounts, they are prepaid and don’t require a large investment...